How do I name D&R Greenway in my will?

The simplest way to make a planned gift is to remember D&R Greenway in your will. A bequest in your will, or in your revocable trust, can be a gift of a specific amount of money or a fraction of your estate. The gift can be made upon your death or it can be a contingent bequest that occurs after a particular event, such as the death of a spouse or the end of a child’s trust. You may also give specific holdings, such as shares of appreciated stock or real estate.

Sample language for a bequest:

“I give, devise and bequeath (dollar amount/percentage/specific asset) to D&R Greenway Land Trust, located in Princeton, New Jersey, for the organization’s general uses and purposes.”

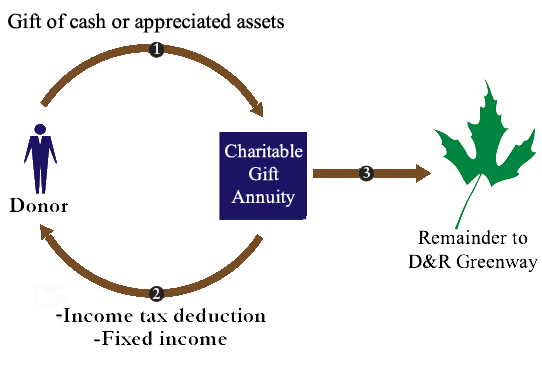

What is a charitable gift annuity, and do I qualify?

A charitable gift annuity is a simple agreement between you and D&R Greenway. For your gift of cash or securities, D&R Greenway agrees to pay one or two people a fixed income every quarter for life. After the donor/annuitant has passed away, D&R Greenway will use the remaining annuity balance for its mission of land preservation, stewardship and to inspire a conservation ethic. D&R greenway’s gift annuity is managed by The Glenmede Trust Company, N.A.

Benefits of charitable gift annuities include:

- Guaranteed fixed income for life

- Charitable tax deduction in the year you make the gift

- Cash or appreciated assets may be gifted

- Part of each payment is tax free

D&R Greenway offers donors the opportunity of two types of immediate gift annuities.

- A single life annuity, for which a donor pays a certain sum and in exchange receives a fixed dollar amount in quarterly installments for life, can be purchased for one’s self or to benefit another individual (e.g. sibling or parent).

- A joint and survivor annuity, funded with either joint property (e.g., a check from a joint account) or with one donor’s property, is paid to both annuitants jointly and after one dies, then all to the survivor. The amount is not diminished by the death of one annuitant. The two annuitants do not need to be married, but both must meet the minimum age requirement. The rate is based upon their joint life expectancies.

How is our charitable gift annuity program managed?

D&R Greenway cultivates and solicits planned gifts and maintains primary contact with donors. We have contracted with The Glenmede Trust Company, N.A. to provide philanthropic advisory services and investment management support through its Princeton office. D&R Greenway requires that annuitants be at least 65 years of age and that annuities be a minimum of $15,000. The annuity interest rate, determined when it is issued, is based on rates recommended by the American Council on Gift Annuities.